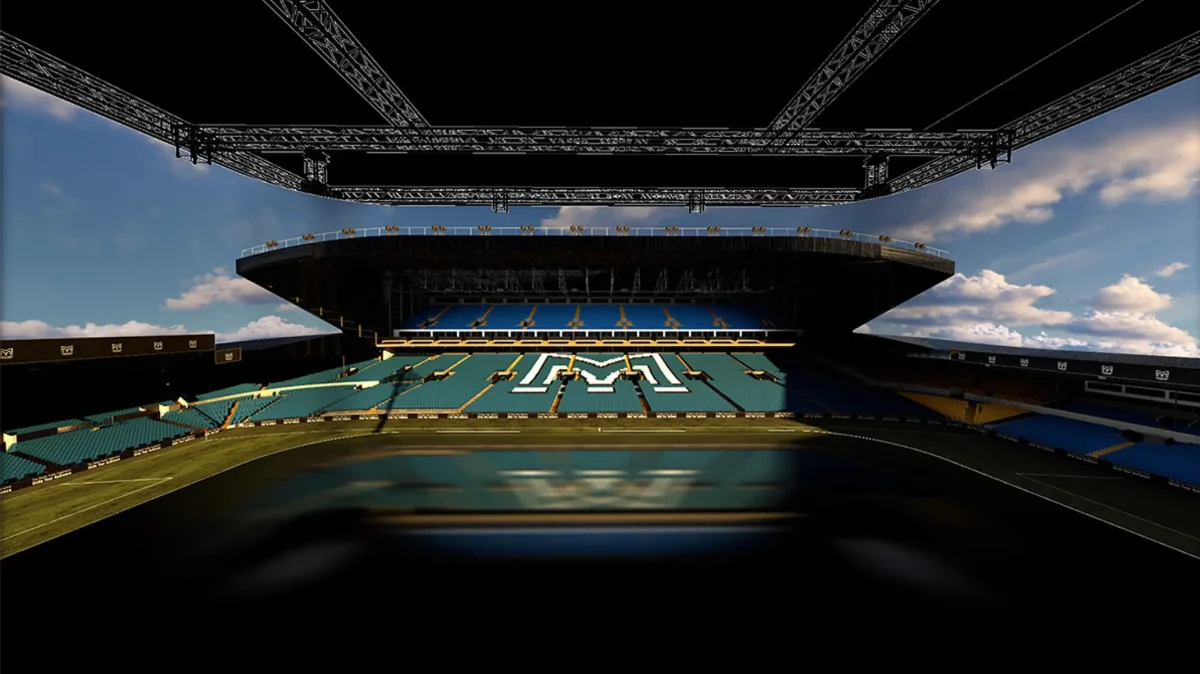

HU – Optimal Audio hit the target at Szigetszentmiklós’ local handball court, with a multi-zone installation that was timed to perfection. The long-awaited audio refresh – supplied by Hungarian distribution partner, BG Event Ltd, and installed by Zoltán Csukay, lead technical specialist at the local cultural centre – improved sound quality and simple day-to-day control for the venue which is operated largely by a non-technical staff.

Simple and practical to use, the Optimal Audio Ecosystem supports both match day action and wider community use. The audio upgrade was completed during a two-week holiday closure as part of a wider programme of maintenance works.

From the outset, the arena was clear about its requirements, with better audio quality topping the list, followed closely by ease of operation for non-technical staff. Reliant on part time staff, the venue needed a solution that would remain consistent, intuitive and dependable regardless of who was behind the controls.

Following consultation, a zoned approach was agreed, allowing audio to be tailored precisely to four distinct areas identified within the arena, while remaining simple to manage as a single system.

The four zones include the main audience area, the play field, the side seating area and a spare zone reserved currently for a legacy 100 V speaker system but offering future flexibility if required.

Around the playfield, a total of four Optimal Audio Cuboid 10 full-range loudspeakers were mounted in portrait mode to ensure clear announcements and even coverage across the court.

The main audience zone also featured Cuboid 10 enclosures supported by two Optimal Audio Sub10 subwoofers for the delivery of impactful, full-range sound for spectators.

Delivering focused coverage along the side seating area, Optimal Audio’s 4-inch, two way UP series of loudspeakers were accessorised as pendant enclosures to create a modern look and the provision of high-quality audio

System control for the four zones – individually or in any configuration up to whole venue – is provided by Optimal Audio’s Zone 4, installed conveniently in the technical room, whilst a ZonePad 4 wall controller, located at the playfield wall, allows full yet easily navigable system control.

The speed at which staff could be trained on the system was one of the clearest measures of success. According to the venue, new technicians were trained to operate the audio confidently within just 15 minutes. With multiple staff operating the system, it remained easy to manage, first via the ZonePad 4, but increasingly via Optimal Audio’s WebApp. Downloaded to phones and other portable devices, WebApp quickly became the preferred way to control the system.

As the arena’s director observed, the ZonePad is retained largely as a safety measure – a testament to how naturally the WebApp fits into daily operation.

Loudspeaker selection was guided by practical listening tests set up by Audio-Technica, comparing Cuboid 8, 10 and 12 models alongside subwoofer options, before settling on the final configuration. The result delivers the required impact and clarity without unnecessary complexity.

With a tight installation window and multiple maintenance activities taking place simultaneously, the speed and straightforward deployment of the Optimal Audio system proved critical. The result is a handball arena now equipped with a system that sounds better, works smarter, and empowers every user – whether they are running a match, making an announcement, or stepping into the role for the very first time.

Photography: Jordan Moore

Thanks to

Distribution Partner: BG Event Ltd

Installation Partner: Zoltán Csukay

Click here for original article.